Cost of Dental Insurance Plans

Affordable Dental Plans and Insurance

Contents

- Affordable Dental Plans and Insurance

- How much does good dental insurance cost?

- Look up Dental Insurance Quotes

- Individual Dental Insurance

- Discount Dental Insurance Plans

- Full Coverage Dental Insurance Plans

- Fee-For-Service Dental Insurance Plans

- Private Dental Insurance

- Dental Insurance Plan Reviews

- Ameriplan Dental Insurance Plans and Benefits

- An Overview of Humana Dental Plans

- Aflac Dental Insurance Plans and Benefits

- Careington Dental Plans and Benefits

- Tricare Dental Plans and Benefits

- Unicare Dental Insurance Plans and Benefits

- Healthplex Dental Insurance Plans and Benefits

- CompBenefits Dental Insurance Plans and Benefits

- GE Wellness Dental Plans and Benefits

- Guardian Dental Insurance Plans and Benefits

- GEHA Dental Insurance Plans and Benefits

- Encore Dental Insurance Plans and Benefits

- AARP Dental Insurance Plans and Benefits

- Aetna Dental Insurance Plans and Benefits

- Deltacare Dental Insurance Plans and Benefits

- What Ameritas Bright One Dental Plans Offer Insured Individuals

- Is Cigna Dental Insurance Right for You?

- United Concordia Dental Insurance: Best Dental Plans Available

- Reviewing Blue Cross Blue Shield Dental Plans

- Reviewing Your Choices Regarding MetLife Dental Plans

Let’s face it. Dental care is expensive, and treatment costs will only go up. By searching and finding some great affordable dental plans and insurance policies, you can save yourself a lot of money and a lot of headaches at the same time. Always review the company you are interested in and read the reviews others have left. It’s always better to know someone else’s horror story to help save you from going through the same thing. Below are some top dental insurance plans and companies and a summary. Click any of the links below to read more about them and write or read a review.

First, here are some questions you should ask about each dental plan you look at:

- How much money will this dental plan cost you every month?

- Ask about the deductible. How high is it, and what will be paid for once it is met?

- Can you choose your dentist, or do you have to choose from their network?

- Exactly what procedures are covered?

- Do you want cosmetic dentistry covered as well as preventative care?

Because dental costs are rising doesn’t mean you should let those high prices keep you from getting the dental care you need. This page showcases the best plan comparison options to help you find an affordable individual or family coverage from the major companies and providers.

There are two basic options for dental coverage. You can take out an insurance policy or enroll in a dental plan. A dental policy is similar to a typical health insurance policy. There are premiums, deductibles, and varying types of coverage. The second option involves joining a plan where, as a group member, you receive discounted services from participating providers.

How much does good dental insurance cost?

Finding a good dental insurance plan can be tricky, almost as challenging as finding a good dentist. This is especially true if you’re not sure you have enough money to get the right plan. Most people forgo buying a dental insurance plan to pay for their medical insurance or medical bills. However, dental insurance can be valuable, especially if your teeth are prone to cavities or other dental problems. If you’re one of the many people who aren’t sure exactly where to start when it comes to buying cheap dental insurance, here are a few tips for you! There are a few significant differences from plan to plan. These will help you decide which plan is right for you:

- The overall cost. Each plan will require you to pay different out-of-pocket costs for different procedures and annual payments. Just because a plan is expensive doesn’t mean you’ll get the coverage you want. On the other hand, just because a plan is cheap doesn’t mean you’ll get terrible coverage. Look at each plan’s specifics to ensure you get precisely what you want.

- Your choice of dentists. The same insurance providers cover not all dentists. You might want to call a few of your local dentists to see what insurance plans they recognize.

- How you’ll pay? Each plan not only covers different procedures, but they require different payment methods as well. You might find that you pay very little for your procedures but have high annual costs or the other way around. You can choose which way is preferable for you.

Look up Dental Insurance Quotes

Before you go about buying your dental insurance plan, make sure you do your research. Don’t settle for the first plan you see because you aren’t sure what else is out there. A good starting point is asking your friends and family what insurance they use. You can also ask about good dentists in your area and see what insurance they accept.

You can also try doing a quick internet search. This can be a very efficient way to find quotes and recommendations since you’ll have a lot of information at your fingertips. However you choose to do it, ensure you understand how much you’ll be paying and what kind of coverage you’ll get with your dental insurance plan. Some companies require different commitments and payment plans, so you’ll want to ensure you do your homework. The more you know about the plan you’re buying, the less likely you are to get taken to the bank.

Individual Dental Insurance

If you’re not planning on having a family anytime soon, then individual dental insurance might be the right coverage plan. Most plans provide fairly basic coverage at great prices. Depending on your needs, some plans provide discounts on individual services such as fillings and root canals. Make sure, though, while you’re buying your plan, that your dentist is covered under it.

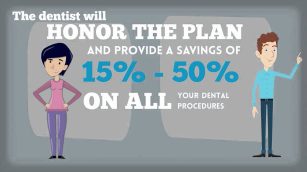

Discount Dental Insurance Plans

Discounted dental insurance plans aren’t insurance plans at all. Some insurance companies offer them to alleviate the cost of different dental procedures. You won’t be covered, but you will receive a discount on any work you have done at a participating dentist’s office for a small monthly or annual fee. Discount plans usually only work with a specific network of dentists, so you’ll have to ensure that your dentist is covered. These plans typically don’t require paperwork or contracts, but you must abide by your provider’s requirements.

Here are some examples of discounts you can get from Discount Dental Insurance Plans:

| Service | Typical Cost* | Discount Plan Cost* | Savings |

|---|---|---|---|

| Routine Checkup | $90 | $20 | $70 |

| Teeth Cleaning | $110 | $48 | $62 |

| Filling (1 surface) | $170 | $78 | $92 |

| Crown (porcelain fused to metal) | $1,300 | $770 | $530 |

| Root Canal (molar) | $1,700 | $900 | $800 |

| Complete Upper Denture | $2,500 | $1,200 | $1,300 |

| Braces (2-year treatment for a child) | $5,600 | $2,700 | $2,900 |

*Costs are approximate and may vary by location and provider. Discounts may also vary depending on the plan and provider. These examples are for illustrative purposes only.

Full Coverage Dental Insurance Plans

If you’ve just had a child or plan on having children soon, then full coverage dental insurance might be something you want to look into, especially since children require a large amount of dental work as they grow. Make sure that the plan you choose suits your needs. Plans that cover the most expensive procedures, such as tooth extractions and root canals, are preferable and will keep you from breaking the bank. Most plans have a maximum annual limit for how much they can cover, so you’ll want to be aware of that. The most important thing to keep in mind, though, is whether or not you’ll be able to afford it. Full-coverage dental options can be expensive, so check your budget before purchasing one to ensure you’re getting your money’s worth.

Fee-For-Service Dental Insurance Plans

If your most significant concern is your choice of dentist, then you’ll probably want to look into a Fee-For-Service dental insurance plan. These are also called “traditional plans” and usually allow the most significant number of dentists under their coverage. This type of plan requires you to pay a certain percentage of whatever your dentist charges; then, your plan will pay the rest. The amount you will pay varies from plan to plan, but you’ll usually pay around 20% of your dentistry needs. Cosmetic dentistry tends to cost a little bit more.

Private Dental Insurance

Private dental insurance can be a good option for employers who do not provide dental insurance. Private treatment options tend to cost more than general public options, but on the bright side, you’ll get more attention from your insurance company and most likely be able to see the dentist you want. If you’re willing to pay the extra fees for your dental coverage, you’ll most likely be satisfied with a private dental insurance option.

Looking for affordable dental insurance doesn’t have to be a massive headache. Begin by asking your friends and family for recommendations. This can save you a lot of time and energy, and your friends will most likely be able to provide you with information on plans at a low cost. And be sure to get quotes and coverage information from whatever company you’re looking into. Make sure that your teeth are in the right hands.

Dental Insurance Plan Reviews

Ameriplan Dental Insurance Plans and Benefits

Ameriplan has some of the most competitive savings in the industry, and with a growing network of more than 30,000 dentists, it’s getting better all the time. It should be…

An Overview of Humana Dental Plans

Humana has made a name for itself in the dental insurance industry, and with over 130,000 dentists nationwide and fast claims, they have a lot of satisfied customers. They have…

Aflac Dental Insurance Plans and Benefits

Aflac! Aflac! Visions of cute little duckies come to mind, don’t they? Well, if you’ve spent even a few minutes each week watching TV, they should. Aflac is one of…

Careington Dental Plans and Benefits

With the Careington Dental plan, you get such amazing prices for just about any dental need you may have now or in the future, it’s just plain crazy. You can…

Tricare Dental Plans and Benefits

So you are a proud member of the National Guard and Reserves, well good for you. We salute you. And now you are also looking for a great dental plan,…

Unicare Dental Insurance Plans and Benefits

Unicare offers some absolutely mind-boggling amazing features and options for all your dental needs, big and small. They cover orthodontics, which is very helpful for families with teens. All the…

Healthplex Dental Insurance Plans and Benefits

Healthplex Dental Insurance Company is definitely known as a leader when it comes to their amazing dental plans. Their plans are considered even better than the rest because ALL they…

CompBenefits Dental Insurance Plans and Benefits

When it comes to the CompBenefits Dental Plan, insurance participants generally can use one of the “participating” dentists listed on their website. It’s super easy to locate a dentist in…

GE Wellness Dental Plans and Benefits

So who is GE Wellness, you ask? Let me tell you. GE Wellness is actually now known under a new name called Signature Wellness, but anyway you call it, it…

Guardian Dental Insurance Plans and Benefits

Guardian Dental Insurance Plans are a type of dental insurance offered by Guardian Life Insurance Company. Guardian Dental Insurance provides coverage for a wide range of dental services, including routine…

GEHA Dental Insurance Plans and Benefits

The GEHA dental plan (also known as the GEHA connection Dental Federal SM Dental Plan) has a few special features that other dental insurance companies just don’t have. GEHA offers…

Encore Dental Insurance Plans and Benefits

Encore dental insurance plans offer some amazing options for you and your family. If you are in current need of any major dental work, and I mean pronto, you have…

AARP Dental Insurance Plans and Benefits

Saving with AARP Dental Insurance PlansContentsSaving with AARP Dental Insurance PlansAbout AARPWhat Will You Get With an AARP Dental Plan?The Benefits of Choosing AARP Dental PlansCostSounds great, but what do…

Aetna Dental Insurance Plans and Benefits

With millions of people already using Aetna dental plans, it’s safe to say that this is one of the better places to look for excellent dental care. But besides offering…

Deltacare Dental Insurance Plans and Benefits

It’s time for a dentist. But which one should you go with? Well, it’s not so much the dentist these days, but finding the right dental PLAN for you and…

What Ameritas Bright One Dental Plans Offer Insured Individuals

Ameritas is a company name associated with various types of insurance. With regard to dental insurance, Ameritas Bright One Dental Plans are inclusive and varied so that there is certain…

Is Cigna Dental Insurance Right for You?

Cigna offers a vast range of plans, and you can switch back and forth between plans if your situation demands it. Their DHMO plan is one of the most desirable…

United Concordia Dental Insurance: Best Dental Plans Available

United Concordia dental insurance offers a great variety of dental plans for affordable prices, and this had caused the company to expand it’s user base to more than 8 million…

Reviewing Blue Cross Blue Shield Dental Plans

Blue Cross has one of the most well-known names in the insurance industry, so what do they offer for dental care? A program called Dental Blue can be a good…

Reviewing Your Choices Regarding MetLife Dental Plans

MetLife is a full service provider in areas such as investments, employee benefits and insurance. MetLife offers more than just basic health insurance and has extended their service offerings to…